How Digital Identity Fuels Remote Account Opening and Onboarding

The economic disruption caused by various lockdowns around the world has had an unusual impact on the financial services industry: it is accelerating digitization. For example, banks have been on the frontlines to help administer loans and quickly get cash to businesses and individuals in financial distress. But while some banks and financial institutions are enabled to serve customers remotely, others are feeling exposed because they simply don’t have the digital identity capabilities to engage with customers in a physically distanced world.

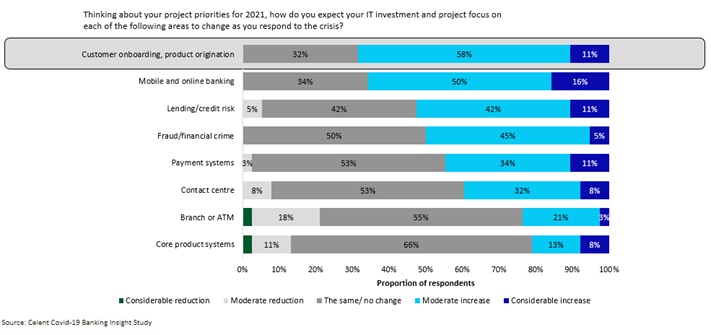

With the initial shock of the coronavirus pandemic over, banks are moving beyond business continuity issues and focusing on their 2021 investment agendas, including digital transformation. In a recent web seminar, Celent’s Head of Retail Banking Practice, Zil Bareisis, cited results from the Celent Covid-19 Banking Insight Study, which highlighted that enhancing digital self-serve capabilities, improving digital onboarding, and reducing operational efficiencies were top priorities for banks. The same study illustrated that most banks plan to increase their IT budgets for customer onboarding and product origination initiatives to respond to changing consumer preferences and habits (see figure 1 below).

Figure 1. IT investment and project focus for banks in 2021

What Does Successful Digital Onboarding Look Like?

Successful customer onboarding in the digital channel needs to deliver on three major requirements:

- Customer experience (CX): CX remains a top driver for digital onboarding initiatives at banks, because the ultimate goal is new customer acquisition. This applies to all digital channels and all steps in the customer journey – from identity verification and consent capture to onboarding and ongoing account access and transactions.

- Cost effectiveness: It’s not enough to deliver a great CX. Banks also need to ensure they leverage the latest remote onboarding technologies to deliver operational efficiencies in the front and back office.

- Regulatory compliance: The digital account opening process includes steps such as identity verification that are tied to Know Your Customer (KYC) regulations. These regulations differ from country to country and need to be accounted for, especially when operating across borders. The good news is that most countries now allow organizations to verify identities remotely as long as the technology has strong fraud detection controls in place.

Modern Identity Verification Is Essential to Improving the Onboarding Experience

With an increasing number of applicants reluctant to go to a bank branch to open a new account, digital identity verification has become a key requirement to enable remote account opening and onboarding experiences. The goal is to ensure that the applicant claiming the identity is in fact the true owner of that identity and is genuinely present during the process. Customer identity verification is also a key ingredient for ongoing fraud monitoring.

Today, banks are increasingly implementing document-centric identity verification techniques. Gartner’s Market Guide for Identity Proofing and Affirmation cites that, “by 2022, 80% of organizations will be using document-centric identity proofing as part of their onboarding workflows, which is an increase from approximately 30% today.” This category of solutions enables organizations to:

- Capture the ID document: Capture a photo of the applicant’s passport, driver’s license, or other identity document – typically via a mobile device.

- Authenticate the ID document: Analyze the ID document to assess signs of tampering or counterfeiting and ensure authenticity. For example, examine the MRZ zone, the expiry date, the font, and the color of the document to ensure that these components are consistent with a real ID document.

- Verify the applicant against the ID document: Compare the photo of the document with a “selfie” (facial biometrics) taken by the applicant submitting the document. Test for the genuine presence of the applicant using “liveness detection”, which identifies whether the presented biometric trait is from a live human or is being spoofed by a digital or manufactured representation.

Banks must also ensure that the agreements are legally binding and admissible in a court of law, because the account opening process is fundamentally an agreement process. To achieve this, we recommend implementing e-signature to capture intent and a step-by-step account of the process.

Because abandonment remains a key challenge in the onboarding process, banks are increasingly relying on more than one identity verification capability to ensure applicants can complete the process in a single-sitting. This includes selecting a vendor with strong identity orchestration capabilities and connections to third parties for identity verification, as well as redundancy through workflows that include failover techniques in the event of latency or downtime.

Digital Identity Spans the Entire Lifecycle of the Customer

Digital identity plays a critical role across all steps in the customer onboarding process – not simply the verification step in upfront account opening process. The lines between identity verification, authentication, and fraud detection are blurring with respect to the techniques that can be used to increase trust in affirming an individual’s identity and identifying fraudulent activities. We’re starting to see a continuum between these capabilities and also seeing the increased ingestion of data across the lifecycle of the customers to stop fraudulent activities during and after the account opening process.

Adapting identity verification and subsequent authentication to risk is essential for the delivery a smooth and secure customer experience. The good news is that banks now have access to machine learning-based technologies with the ability to ingest contextual and behavioral data about customers, the devices they use, and the transactions they carry out to assess risk. Depending on what the customer is trying to do, risk-based assessments and scores can be used to drive intelligent workflows that trigger actions (i.e., re-authenticate the customer) to then stop fraud from taking place.

Final Thoughts

Because nearly every aspect of modern life today embraces remote channels, the need to obtain confidence in the identities of consumers, partners, and employees through remote interactions continues to grow. Government entities like the Financial Action Task Force (FATF) agree that if done right and if appropriate risk measures are in place, the risk of transacting in a non-face-to-face environment can actually be lower than the identity and authentication techniques that banks and other financial institutions have traditionally deployed in the branch.

Watch our webinar with Celent’s Head of Retail Banking Practice to learn about the pressing identity verification and authentication issues that are front and center in today’s remote world and best practices for connecting remote applicants to real identities.